This is a long-only, mechanical (rule-based) trading strategy based on abnormal stock market returns in periods preceding the FOMC rate decision conferences, as described in this educational (free-access) post: Pre-FOMC Announcement Drift

It can be traded on S&P index ETFs like SPY, IVV, and VOO, index options, or futures like ES_F (full-sized futures contracts) or MES_F (micro-sized futures contracts).

This strategy triggers near the market close and typically holds a position for one day (actually overnight and part of the next day).

The FOMC Trade in SPY, on average, executes 5 trades per year.

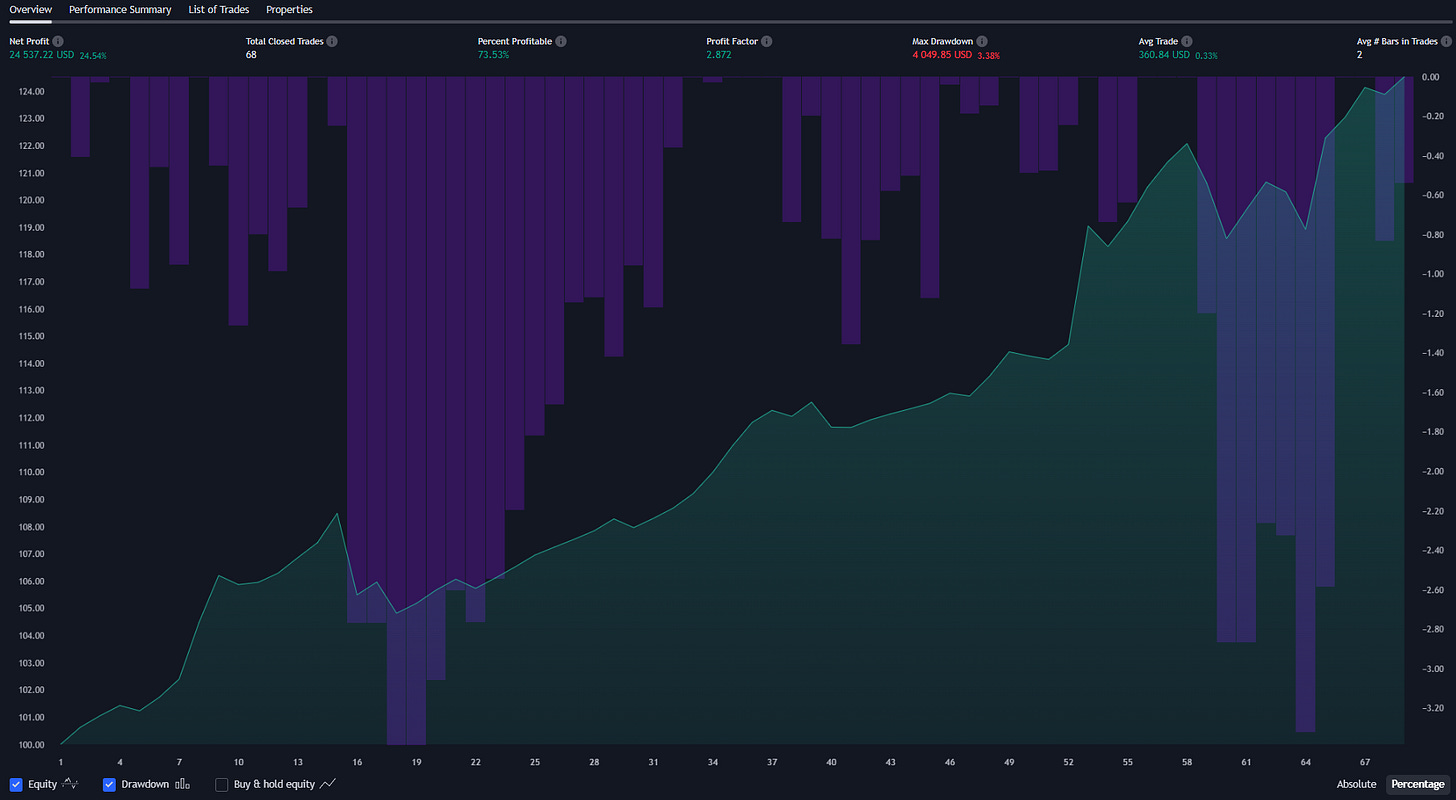

The P&L chart of this strategy looks as follows (SPY, no leverage, $100K account):

Strategy statistics:

Net Profit: 24.54%

Max Drawdown: 3.38%

Total Closed Trades: 68

Percent profitable: 73.53%

Profit factor: 2.872

While the presented statistics may not look impressive, please bear in mind that this strategy is typically invested in only during 5 overnight sessions a year when certain technical pre-conditions are met to increase the probability of this trade. Also, due to the very low drawdown, this trade can be leveraged.

Like most of our strategies, this one is also meant to be traded as part of a portfolio of diversified strategies. Due to the fact that it typically holds positions for a short period of time, it allows for good usage of working capital and fast compounding of gains.

TradeMachine subscribers receive email alerts with position updates each time this strategy enters or exits a trade. Some strategies include take-profit and stop-loss price levels.

Past performance is not indicative of future results. Results based on simulated or hypothetical performance have certain inherent limitations. All posts are subject to the disclaimer on the About page.