Pre-FOMC Announcement Drift

In today's post, we discuss the abnormal stock market returns in periods preceding the FOMC rate announcements.

To gain a better understanding of the Pre-FOMC Announcement Drift anomaly and check if we can utilize it in our trading strategies, we studied the available research papers on the matter, as described below:

In their significant study, Lucca and Moench (2015) identify that U.S. stock markets typically see a considerable increase in returns, averaging 49 basis points, in the 24 hours preceding scheduled Federal Open Market Committee (FOMC) announcements. This period, spanning from September 1994 to March 2011, accounts for around 80% of the total annual returns. This phenomenon remains unexplained by traditional asset pricing models, presenting a challenge to established financial theories.

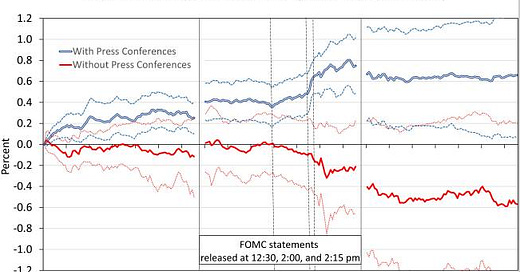

In their 2019 research, Boguth et al. (BGM) expanded the analysis period to September 2017 to examine the effects of the new communication strategy introduced by the FOMC in April 2011, which included press conferences by the FOMC Chair. These conferences occurred after every other FOMC meeting and were aimed at improving the transparency and immediacy of the Federal Reserve's monetary policy communications, as stated by the Bank in 2011. BGM discovered that the pre-FOMC market movement was primarily associated with announcements followed by press conferences. This is attributed to investors' heightened expectations and increased focus on meetings that were accompanied by press conferences, as opposed to those that were not. Furthermore, they observed that this market drift started at the opening of the stock market on the day before the announcement, which is earlier than what was observed during the period analyzed by Lucca and Moench.

Chen and Clements (2007) demonstrate a decrease in the VIX, an index measuring market risk and investor sentiment, on FOMC meeting days. Vähämaa and Äijö (2011) arrive at a similar conclusion, linking the reduction in uncertainty to monetary policy decisions. Fernandez-Perez and Frijns (2017) reinforce these findings using intraday data, rather than daily data, and connect the reduction in uncertainty to the clarification of market conditions. Amengual and Xiu (2018) discover that decreases in market volatility are associated with the resolution of uncertainty stemming from FOMC announcements and speeches by the Federal Reserve Chair. Furthermore, Gu et al. (2018) differentiate between FOMC meetings that do and do not include press conferences, finding that uncertainty levels are elevated on days when the meetings are followed by a press conference.

After analyzing the mentioned papers, we decided to perform our own research to explore the possibility of capitalizing on this phenomenon described by the academics. Our research has shown that, while this effect is slowly disappearing in periods of stable monetary policy, as discussed by Kurov, H. Wolfe, and Gilbert (2020), after accounting for some additional technical filters, we are still able to find profitable trading opportunities based on the Pre-FOMC announcement drift.

Thanks to the above analysis, we developed the following trading strategy, which is available to our subscribers:

Strategy: FOMC Trade in SPY

This is a long-only, mechanical (rule-based) trading strategy based on abnormal stock market returns in periods preceding the FOMC rate decision conferences, as described in this educational (free-access) post: Pre-FOMC Announcement Drift It can be traded on S&P index ETFs like SPY, IVV, and VOO, index options, or futures like ES_F (full-sized futures co…