Strategy: The Great Compounder for SPY

Trades generated by this strategy are available to paid subscribers

The Great Compounder for SPY is a long-only, rule-based swing trading strategy that tries to capitalize on the highly mean-reverting characteristic of the S&P 500 stock index and the overnight drift phenomenon.

It can be traded on S&P index ETFs like SPY, IVV, VOO, index options or futures.

This strategy triggers near the market close and typically holds a position for 6 days.

One interesting aspect of this strategy is its affinity for volatility; it performs well regardless of the overall stock market direction, even during downtrends. Our backtests have shown that while using trend filters can achieve slightly smaller drawdowns, this actually decreases its performance significantly, leading us to opt out of using them.

The Great Compounder for SPY, on average, executes 20 trades per year. It typically trades more frequently in volatile markets and less so during periods of relative calm.

This is one of our flagship strategies and a great example of the power of capital compounding. Thanks to holding positions only for short periods of time, it's a perfect fit as part of a portfolio of diversified trading strategies.

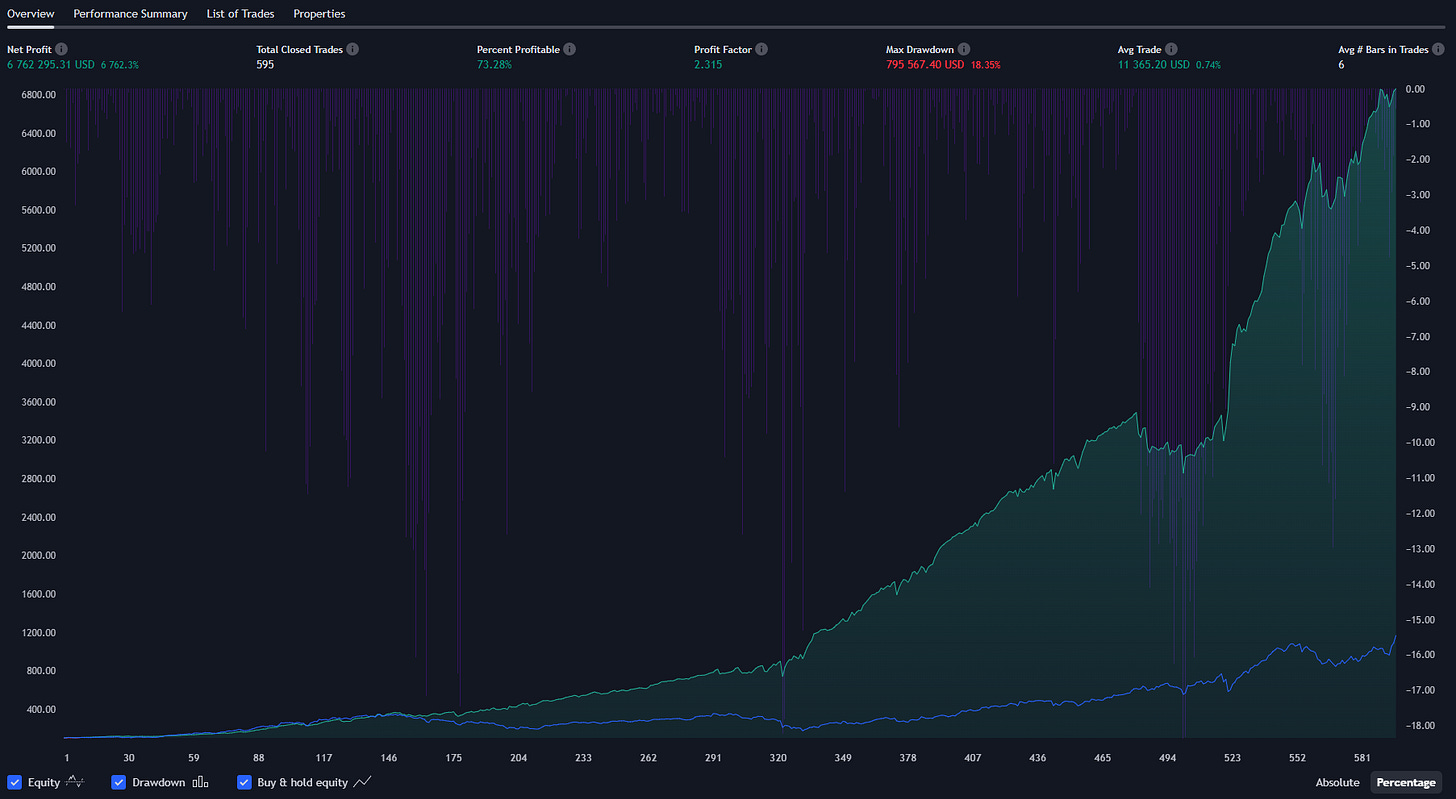

The P&L chart of this strategy looks as follows (SPY, no leverage, $100K account):

Strategy statistics:

Net Profit: 6,762.3%

Max Drawdown: 18.35%

Total Closed Trades: 595

Percent profitable: 73.28%

Profit factor: 2.315

An alternative version of this strategy is currently in development; it will use options contracts on the SPX instead of the SPY ETF itself to capitalize on the options Theta decay. Details of the options-based version will be advertised in the near future.

TradeMachine subscribers receive email alerts with position updates each time this strategy enters or exits a trade. Some strategies include take-profit and stop-loss price levels.

Past performance is not indicative of future results. Results based on simulated or hypothetical performance have certain inherent limitations. All posts are subject to the disclaimer on the About page.

What a monster, man!