Strategy: Oversold Bounce Trade in TLT

Trades generated by this strategy are available to paid subscribers

This is a long-only, mechanical (rule-based) counter-trend bond swing trading strategy.

It was developed to trade the 20+ Year Treasury Bond ETF (ticker: TLT) but can also be traded on futures contracts like ZB_F or micro-sized Treasury yield futures. When you opt to trade on micro yield futures, remember to invert the direction of the trade since yields move in the opposite direction to bond prices.

This strategy tries to capitalize on sharp bounces off the very oversold condition. Thanks to its fully mechanical nature, it can do what most investors are told not to do, that is, to “catch falling knives” in a downtrend.

The fundamental reasons for this strategy to work are as follows:

Crowding of short sellers

Risk-aversion of long term buyers

Short term upside deviation of risk premium

In such conditions, we get rewarded for providing liquidity and taking risk when most investors are not willing to.

This strategy typically trades four times a year and holds a position for an average of four days.

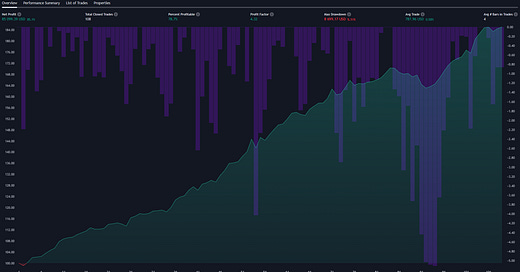

The P&L chart of this strategy looks as follows (TLT, no leverage, $100K account):

Strategy statistics:

Net Profit: 85.10%

Max Drawdown: 5.11%

Total Closed Trades: 108

Percent profitable: 78.7%

Profit factor: 4.32

The average trade hold period of 4 days is a capital-friendly way to gain long exposure to Treasury bond market while locking in our working capital only for a short period of time.

Thanks to this feature, like most of our strategies, this one is also meant to be traded alongside multiple other strategies from our portfolio to allow fast compounding of returns.

How to get this strategy

Paid TradeMachine subscribers receive email alerts with position updates each time this strategy enters or exits a trade. Some strategies include take-profit and stop-loss price levels.

Past performance is not indicative of future results. Results based on simulated or hypothetical performance have certain inherent limitations. All posts are subject to the disclaimer on the About page.