Strategy: Midweek Mean Reversion Trade in Gold

Trades generated by this strategy are available to paid subscribers

Midweek Mean Reversion Trade in Gold is a long-only, mechanical (rule-based), swing trading strategy for Gold.

Entries and exits of this strategy are based on a daily data.

It can be traded on Gold ETF trackers like GLD, IAU, and similar funds, ETF options, or full-sized GC_F or micro-sized MGC_F futures.

This strategy triggers near the market close (NYSE time) and typically holds a position for 2 days.

As the name suggests, it's a mean reversion type of trade based on a day-of-the-week anomaly that we observed in gold market prices. Technical and time-based rules are applied to spot high-probability opportunities for short-term dip buying.

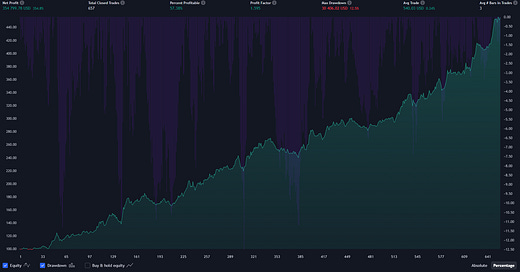

The P&L chart of this strategy looks as follows (GLD, no leverage, $100K account):

Strategy statistics:

Net Profit: 354.80%

Max Drawdown: 12.50%

Total Closed Trades: 657

Percent profitable: 57.38%

Profit factor: 1.595

Trade frequency depends on the short-term volatility of the gold market. It'll typically trade more often in periods when gold is out of balance. In some periods, it may trigger multiple times a week, while in longer-term consolidation periods, it may trade on rare occasions.

We reveal the above details to make subscribers prepared for what may be necessary to properly follow this trade. Due to its nature, it may incur a series of small losses. But the historical performance of this trade has shown it's important not to give back if that happens because usually, some big winners are coming thereafter.

We believe that adding some commodity exposure serves an important role in the construction of a portfolio of algorithmic trading strategies. Gold returns tend to be loosely correlated with stock market returns and can enhance the portfolio's resilience to unexpected market downturns because gold is often considered a safe-haven asset.

Like our other strategies, Midweek Mean Reversion Trade in Gold is designed to be traded as part of a portfolio. This strategy typically holds trades for short periods of time. This capital-friendly approach allows for optimal usage of working capital and fast compounding of returns.

TradeMachine subscribers receive email alerts with position updates each time this strategy enters or exits a trade. Some strategies include take-profit and stop-loss price levels.

Past performance is not indicative of future results. Results based on simulated or hypothetical performance have certain inherent limitations. All posts are subject to the disclaimer on the About page.