Strategy: Bullish Breakout Trade in Bitcoin

Trades generated by this strategy are available to paid subscribers

Due to popular demand and the availability of spot Bitcoin ETFs, we designed this long-only, rule-based, trend-following swing trading strategy for cryptocurrencies, especially for Bitcoin.

It can be traded on Bitcoin ETF trackers like GBTC, IBIT, FBTC, ARKB, BITO, and similar funds, options, or futures.

This strategy triggers near the market close (NYSE time) and typically holds a position for 22 days.

This strategy is based on the following concepts:

Monetary debasement as a fundamental factor

Momentum

Trend-following

Thanks to the built-in technical filters, this strategy ensures it’s trading on the long side of the market only when the market itself displays bullish momentum. Trend filtering methods used in this strategy are time-proven and well-tested with our other strategies and can free investors from the setbacks of emotional trading.

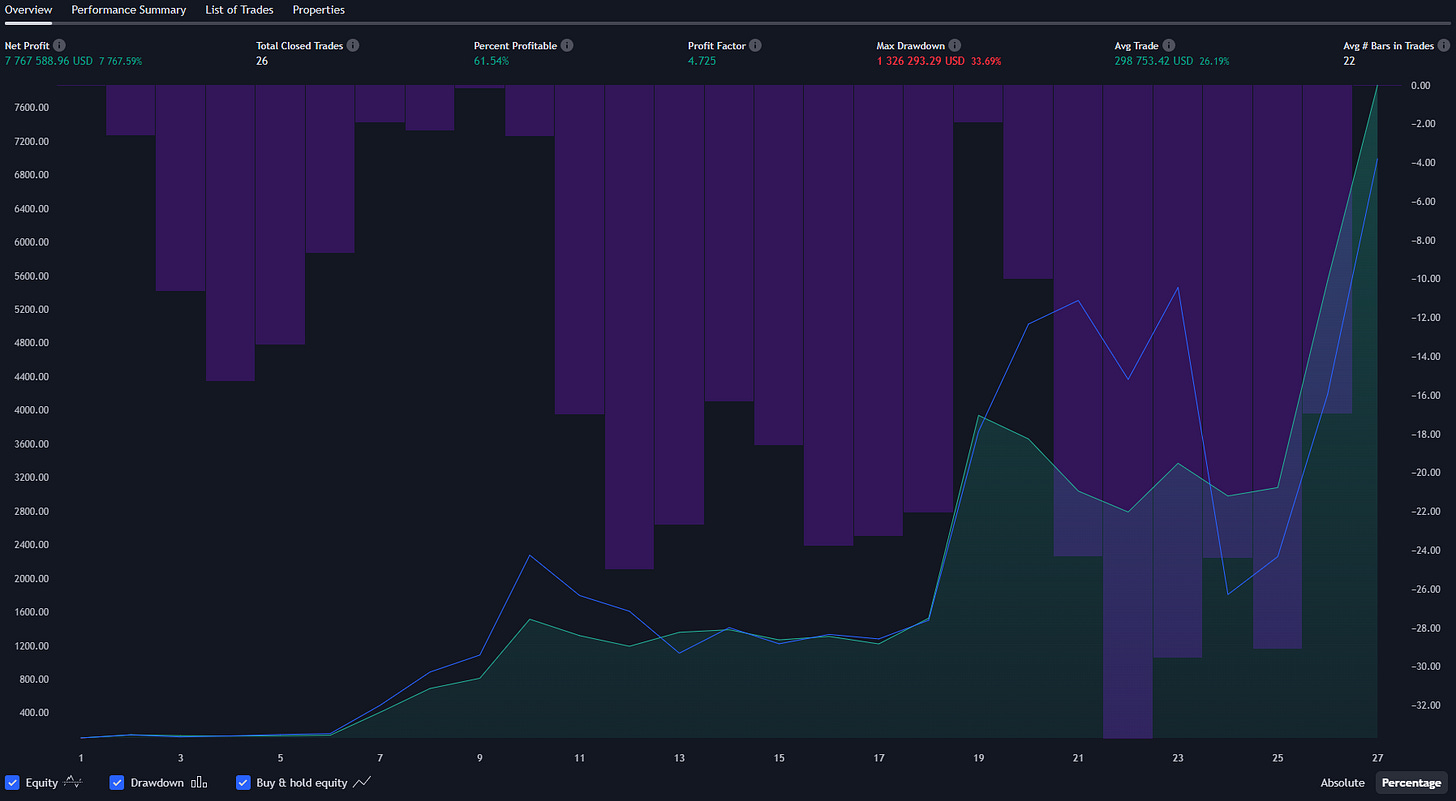

The P&L chart of this strategy looks as follows (GBTC, no leverage, $100K account):

Strategy statistics:

Net Profit: 7,767.59%

Max Drawdown: 33.69%

Total Closed Trades: 26

Percent profitable: 61.54%

Profit factor: 4.725

Avg # Bars in Trades: 22

Please note that due to the highly volatile nature of the cryptocurrency markets, some common sense logic should be applied to position sizing. Typical annualized Bitcoin volatility is in the range of 2-5x that of stock index volatility, so according to the good practices of volatility targeting, position sizes of at most 20% of the positions that one would use while trading the stock market index are a reasonable starting point to account for volatility.

Like most of our strategies, this one is also not designed to trade on leverage, and we prefer to rely on capital compounding to achieve outsized returns instead.

TradeMachine subscribers receive email alerts with position updates each time this strategy enters or exits a trade. Some strategies include take-profit and stop-loss price levels.

Past performance is not indicative of future results. Results based on simulated or hypothetical performance have certain inherent limitations. All posts are subject to the disclaimer on the About page.